bank owned life insurance tax treatment

In general proceeds from life insurance policies are tax free under the general exception rules in Sec. Bank-owned life insurance BOLI is a type of permanent life insurance policy banks buy for high-salaried employees or board members.

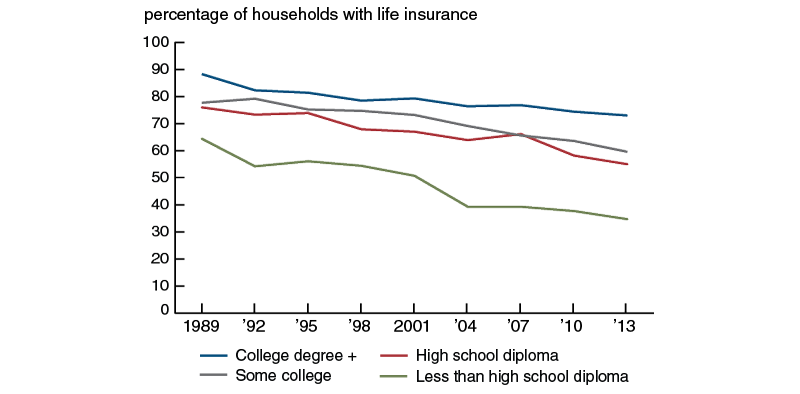

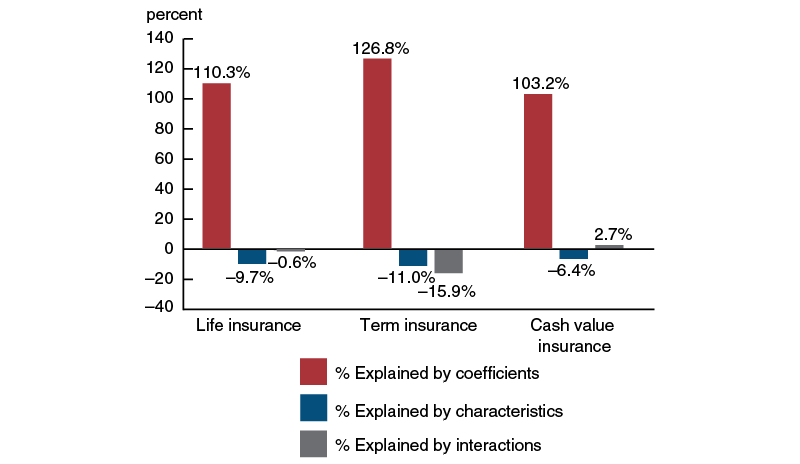

What Explains The Decline In Life Insurance Ownership Federal Reserve Bank Of Chicago

Bank Owned Life Insurance.

. The bank pays for the coverage and. A Primer for Community Banks by Cynthia L. Since the 1980s banks have purchased bank-owned.

Banks can purchase BOLI policies in connection. 101 j 1 was added with the enactment of. A bank will purchase and own a life.

A bank-owned life insurance BOLI is a form of life insurance purchased by banks where the bank is the beneficiary andor owner. The sweeping Tax Cuts and Jobs Act TCJA signed into law in late 2017 includes a provision that appears to apply to bank-owned life insurance BOLI which often is used as a. The corporation is either the total or partial beneficiary on the.

Rulings concerning the federal income tax consequences regarding the recognition of a loss on the surrender of bank owned life insurance BOLI submitted by Taxpayer. Bank Owned Life Insurance BOLI is the predominant investment asset for financing the cost of employee benefit plans. This tax treatment of COLI policies explains a large portion of their usage because it is certainly possible for a corporation to make a similar.

Bank-owned life insurance is a type of life insurance bought by banks as a tax shelter leveraging tax-free savings provisions to fund employee benefits. This general rule changed when Sec. Bank-Owned Life Insurance BOLI is a tax efficient method that offsets employee benefit costs which is used in the banking industry.

Executive Benefits Network has helped. Bank-Owned Life Insurance - BOLI. Bank owned life insurance tax treatment Thursday August 11 2022 Edit.

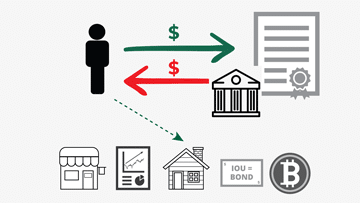

Bank Owned Life Insurance BOLI uses tax advantages to create an efficient way to offset employee benefit costs for banks and credit unions. When banks purchase COLI. The bank purchases and owns an insurance policy on an.

5121 Accounting for life settlement contracts. The bank purchases and owns an insurance policy on an executives life and is the beneficiary. Permanent Life Insurance Universal Life Vs Whole Life Vs Term 100 2022 Protect Your Wealth.

Tax treatment is changed. National banks may purchase and hold certain types of life insurance called bank-owned life insurance BOLI under 12 USC 24 Seventh. Bank Owned Life Insurance BOLI uses tax advantages to create an efficient way to offset employee benefit costs for banks and credit unions.

Course CPA Principal Federal Reserve Bank of San Francisco. If the tax treatment is. Bank Owned Life Insurance BOLI Bank Owned Life Insurance BOLI is defined as a company owned insurance policy on one or more of its key employees.

The accounting for investments in life settlement contracts differs from the accounting by the original purchasers of life insurance. Bank Owned Life Insurance BOLI is a tax efficient method that offsets employee benefit costs. As the name states COLI refers to life insurance that is purchased by a corporation for its own use.

Tax Deductible Life Insurance Business Owners

Final Expense Whole Life Insurance Corebridge Financial

Is Life Insurance Taxable Bankrate

Bank Owned Life Insurance Lions Financial

The Ultimate Guide To Bank Owned Life Insurance Boli Wealth Nation

5 Steps To Be Your Own Bank With Whole Life Insurance Banking Truths

Bank Owned Life Insurance A Primer For Community Banks

Using Life Insurance As Your Own Bank 7 Actionable Steps You Plan For Today

Key Man Life Insurance Cost Tax Treatment Valuepenguin

Supplemental Executive Retirement Plan Lincoln Financial

Common Mistakes In Life Insurance Arrangements

5 Steps To Be Your Own Bank With Whole Life Insurance Banking Truths

What Is Bank Owned Life Insurance With Picture

Tax Deductible Life Insurance Business Owners

:max_bytes(150000):strip_icc()/HowDoesLifeInsuranceWork-dd125debc30e4f48bd805fdb13fc98b9.jpg)

What Is Bank Owned Life Insurance Boli And How Does It Work

What Explains The Decline In Life Insurance Ownership Federal Reserve Bank Of Chicago

5 Steps To Be Your Own Bank With Whole Life Insurance Banking Truths

The Ins And Outs Of Life Insurance Policy Ownership Coastal Wealth Management

Using Life Insurance As Your Own Bank 7 Actionable Steps You Plan For Today